In July 2025, global financial markets witnessed a remarkable upswing driven by a wave of major trade agreements involving the world’s largest economies. From Washington to Tokyo, Brussels to Jakarta, a series of diplomatic and economic deals has reshaped global trade dynamics, triggered renewed investor optimism, and eased fears of protectionism and stagnation that have haunted economies for years.

These developments come at a critical time when nations are trying to recover from the economic aftershocks of the post-pandemic era, prolonged inflation cycles, and geopolitical tensions. Let’s explore how and why these trade agreements have rejuvenated market sentiment globally.

U.S.–Japan Tariff Deal: A Strategic Win-Win

Perhaps the most significant breakthrough came from a high-profile agreement between the United States and Japan, which had been negotiating behind closed doors for months.

Key Points of the Deal:

- The U.S. agreed to reduce tariffs on Japanese automobile and technology exports from 25% to 15%.

- Japan committed to investing over $550 billion into U.S. industries, particularly in defense, aviation (notably Boeing), and agricultural imports.

- Tokyo will also enhance its military purchases and align its defense spending with American interests in the Indo-Pacific.

This agreement comes at a time when Japan is strengthening its posture amid regional tensions with China and North Korea. For the U.S., the deal secures strategic military and economic alignment with a key ally while also satisfying domestic business lobbies—especially automakers and tech companies.

Market Impact:

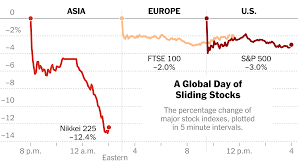

- Japan’s Nikkei 225 surged 1.6%, reaching its highest level since early 2022.

- U.S. indices also jumped: Dow Jones rose by over 230 points, S&P 500 increased by 0.4%, and Nasdaq added 0.3%.

- The Japanese yen gained against the dollar, showing investor confidence in Japan’s export-driven recovery.

U.S.–EU Trade Truce: Reviving Transatlantic Commerce

Another major development was the announcement of a U.S.–EU trade agreement. For years, transatlantic trade had been marred by tariffs on steel, aluminum, aircraft, and agricultural goods. This new deal signaled a return to cooperation.

Highlights:

- Both sides agreed to reduce or eliminate tariffs on nearly $120 billion worth of goods, including machinery, chemicals, and food products.

- The EU pledged to increase LNG and semiconductor imports from the U.S. to reduce dependency on China and Russia.

- Digital taxation frameworks were also introduced to reduce friction over tech giants’ revenues.

This deal was widely welcomed in financial and manufacturing sectors across Europe, with relief that a trade war with the U.S. had been averted.

Market Response:

- The Euro Stoxx 600 and Germany’s DAX index climbed by 1.3%.

- The euro appreciated, trading above $1.18 for the first time in three months.

- Industrial and consumer goods stocks in both regions led the rally, signaling revived confidence in global trade.

https://snaphub.host/wp-content/uploads/2025/07/global-market-2.jpeg

U.S.–China Tariff Pause: A Cautious Thaw

Although not a comprehensive agreement, the U.S. and China agreed to a 90-day tariff pause. This truce followed mounting pressure from global corporations and supply chain disruptions.

Developments:

- Tariffs on over $500 billion in goods were temporarily reduced from 25% to around 10%.

- China committed to importing more U.S. soy, LNG, and high-tech equipment.

- The U.S. hinted at resuming dialogue on issues like IP theft, cybersecurity, and tech access.

While the deal lacked the substance of a formal treaty, markets responded favorably, hoping it marked a shift away from economic hostility.

Economic Reactions:

- The Nasdaq rose nearly 4%, driven by gains in Apple, Microsoft, and Nvidia.

- Global supply chains—especially electronics and manufacturing—saw immediate relief, leading to optimism in Asia-Pacific economies.

- The yuan gained value, and Chinese stocks rebounded after months of stagnation.

🇵🇭 🇮🇩 U.S. Pacts with Southeast Asia

In parallel, the U.S. finalized bilateral trade agreements with the Philippines and Indonesia, two of Southeast Asia’s fastest-growing economies.

What They Include:

- Introduction of ~19% flat tariffs on select goods, mostly industrial and electronic components.

- Infrastructure funding and investment into green energy, public transport, and digital commerce.

- Joint security frameworks under the Indo-Pacific strategy, further cementing America’s geopolitical outreach.

These countries are becoming manufacturing alternatives to China—part of a global “friendshoring” trend that reduces reliance on authoritarian or unstable regimes.

Regional Impact:

- Indonesia’s JSX and Philippines’ PSE indexes rose ~2% after the announcements.

- The Australian dollar and Singapore dollar gained amid rising regional trade confidence.

- Multinational firms like Samsung, Intel, and Amazon praised the agreements, signaling likely expansions in the region.

What This Means for Global Markets

Investor Sentiment

These trade deals reignited bullish sentiments across sectors that had been subdued—manufacturing, tech, transport, and agriculture. There’s a perception that governments are finally willing to prioritize economic cooperation over political grandstanding.

Currency & Commodity Impact

- Gold prices increased, signaling ongoing hedging amid global uncertainty.

- Oil climbed back to the mid-$60s per barrel, largely due to expected industrial demand.

- Currencies like the euro, yen, and Australian dollar saw gains, while the U.S. dollar slightly weakened, reflecting a shift in global risk appetite.

Sectors that Gained:

- Automobiles: Relief from Japanese tariffs buoyed Toyota, Honda, and Ford.

- Semiconductors: With global supply routes stabilizing, chipmakers like TSMC, Nvidia, and AMD posted gains.

- Defense & Energy: As countries inked energy and military investment commitments, firms like Lockheed Martin, Raytheon, and ExxonMobil also saw rallies.

Challenges and Uncertainties Ahead

Temporary Nature of Agreements

Most deals—especially with China—are time-bound or conditional. If diplomatic tensions flare again, tariffs could return.

Underlying Issues Persist

Disputes over intellectual property, digital taxation, labor standards, and data security remain unresolved.

- Geopolitical Risks

Conflicts in Taiwan, Ukraine, and the South China Sea can destabilize trade at any moment. These deals may just be peace-time pauses in a longer strategic rivalry. - Economic Slowdowns

Despite trade optimism, concerns about global economic slowdown and stagflation—particularly in Europe and parts of Asia—still hover.